Putting the Pieces of the Financial Puzzle Together

Helping Board of Directors understand the pieces of the puzzle they are provided by Larlyn Property Management Ltd. to ensure they are using fees collected from owners the best way possible for the condo corporation and it is prepared appropriately for the future.

- OVERVIEW – What Can You Expect To Learn?

- CONDO FINANCIAL STATEMENTS

- CONDO CORPORATION BUDGETS

- CONDO RESERVE FUND

- IN SUMMARY

1. Overview – What Can You Expect To Learn?

- Why do you need financial statements?

- What is included in a typical financial statement package?

- Balance Sheet

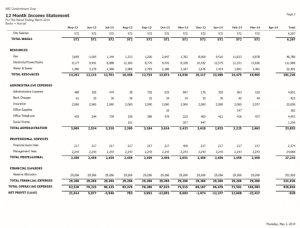

- 12 Month Income Statement

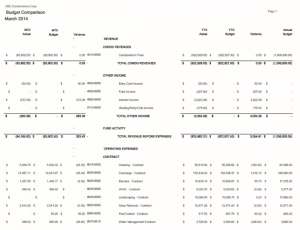

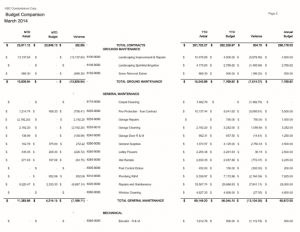

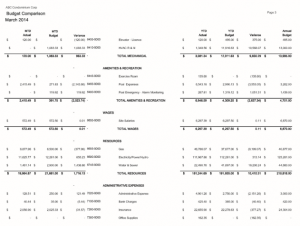

- Budget Comparison

- Additional Working Papers and Reconciliations

- General Ledger

- Notes to Financial Statements

- What do the tools in my package tell me?

- Why do you need a condo corporation budget?

- What is included in a typical condo corporation budget?

- Standard Operating Expenses

- Reserve Contribution

- Surplus Required

- Supplementary Sources of Income

- Condo Fees

- The Anatomy of the Budget

- Who Does What?

- What is a Special Assessment?

- The Big Decision: Condo Fees – To Increase or Not

- What are funds used for?

- How much should be kept in savings?

- Implications / Consequences of your decisions as a Condo Board Member

2. Condo Financial Statements

WHY DO YOU NEED FINANCIAL STATEMENTS?

Condo financial statements are a recurring report of the financial health of the Condominium Corporation used by a variety of stakeholders, including:

OWNERS:

- A record of stewardship used by owners to evaluate directors’ performance .

- Understand the financial performance of their corporation.

BOARD OF DIRECTORS:

- Decision making tool to ensure they are using condo fees collected by owners the best way possible.

- Assist in making sure the Condominium Corporation is prepared appropriately for the future.

THIRD PARTIES:

- Provide status information for managers, potential purchasers, real estate lawyers, reserve fund study consultants, trade creditors, mortgagees, commercial lending institutions and government agencies.

WHAT IS INCLUDED IN A TYPICAL FINANCIAL PACKAGE?

- Financial Records of all assets, liabilities and equity

- Statement setting out the amount of the capital replacement reserve fund (Section 44)

- Other information as the board may determine or as may be directed by a resolution passed at a general meeting

- Balance Sheet

- Statement of Reserve Fund Operations

- Prescribed information relating to the reserve fund study and the operation of the reserve fund

- Indication of the aggregate remuneration paid to the directors in that capacity and the aggregate remuneration paid to the officers in that capacity

- Additional statements or information that the regulations made under this Act require

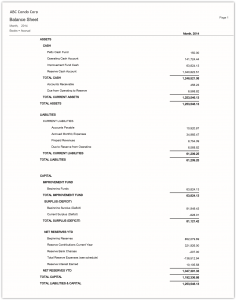

Balance Sheet

Collection of Working Papers and Reconciliations:

- Reserve Fund Summary

- Accrued Liabilities

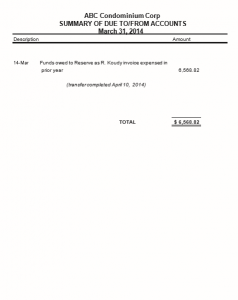

- Due To/From Reserve Fund and

- Operating Accounts

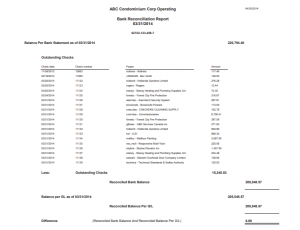

- Bank Reconciliation

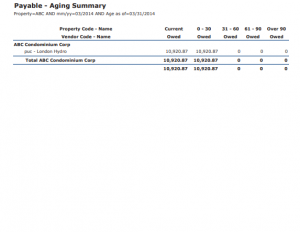

- Aged Payables Summary

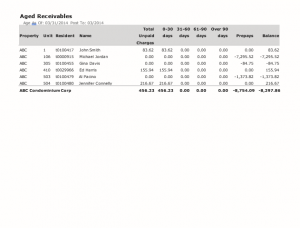

- Aged Accounts Receivable

- General Ledger

- Notes to the Financial Statements

Financial packages are provided monthly to the Board of Directors by a specific date as outlined in the Condo Corporation’s management agreement.

Larlyn takes pride in making these tools available 24/7 through the Resident Portal.

Note that the types of tools included in each package vary by the Condo Corporation’s unique needs and depend on what was outlined in the management agreement.

BALANCE SHEET

This balance sheet example represents a “snapshot” of the financial position of your condominium at a specific point in time (for example, As at December 31st). A balance sheet is broken out into three major components:

- Assets

- Liabilities

- Equity

ASSETS – LIABILITIES = EQUITY

It is called a “BALANCE SHEET” because when Assets = Liabilities + Equity, you are “balanced”

ASSETS

Assets typically refer to the collective property and resources owned by the condo corporation. These positive, valuable items can include:

- Petty Cash – cash kept on hand and used to make small payments

- Operating Cash Account – funds available for the day-to-day operations

- Reserve Cash Account – funds available to pay for expenses designated as Reserve Expenses

- Investments – Reserve – accumulated reserve funds that have been invested for an agreed amount of time (not readily available for use)

- Accrued Interest – interest earned to date on the above

- Prepaid Expenses – expenses paid in advance, the benefits of which will be consumed in the near term (for example, insurance)

- Accounts Receivable – amounts owing to the condo corporation as of reporting date but not yet received

- Miscellaneous Accounts Receivable / Sundry Receivables – items earned but cash not yet received (example: laundry income)

- Due from Operating – funds due to the reserve from the operating account but as of the reporting date not yet transferred

LIABILITIES

Liabilities refer to the financial obligations and debts that the condo corporation owes. These negative things include:

- Accounts Payable – invoices received for operating expenses but as of the reporting date not yet paid

- Accrued Expenses – expenses that have been incurred for the reporting period, but no invoices have been received as of the reporting date and are unpaid (example: purchase order issued, goods/services received, invoice not received to be entered as a payable or paid)

- Prepaid Condominium Fees – condominium fees paid to the Corporation in advance of their due date.

- Due to Reserve – funds due to the reserve from the operating account but as of the reporting date have not been transferred

EQUITY

Operating Surplus (Deficit)

- Operating Surplus (assets exceed liabilities) – it is important to remember that this does NOT represent excess cash available. The surplus can be comprised of assets other than cash.

- Operating Deficit (liabilities exceed assets) – occurs when the corporation is not in a strong financial position and owes more than it can take in. The Board of Directors should seriously consider authorizing a special assessment or increasing maintenance fees to strengthen the Corporation’s financial position and not deplete reserves.

- Beginning Surplus (Deficit) – operating surplus or deficit since the inception of the condominium up to and including the previous year-end (often referred to as Retained Earnings)

- Current Surplus (Deficit) – year to date operating results. This amount equals the Net Income under the Year-to-Date Actual column on the Budget Comparison Statement.

Reserve Fund

The funds available as of the reporting date to meet the requirements in accordance with the Reserve Fund Study.

- Beginning Reserves – the balance of the Reserve Fund as of the previous year’s end.

- Reserve Contributions – funds transferred from the operating account to the reserve account during the current year per the current year budget.

- Reserve Interest – interest earned on the funds held in the reserve bank account(s) and investments for the current year.

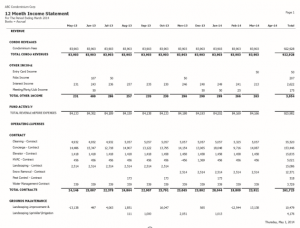

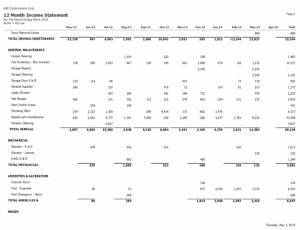

12 MONTH INCOME STATEMENT

An income statement for a condo corporation presents actual operating income and expense activity by month across a rolling 12-month period.

NET PROFIT (LOSS) = OPERATING INCOME – OPERATING EXPENSES – FINANCIAL EXPENSES

shown on Balance Sheet as the Current Surplus (Deficit)

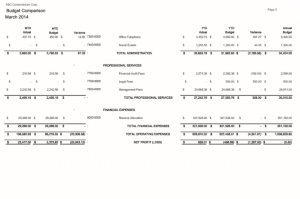

BUDGET COMPARISON

A budget comparison presents actual operating income and expense activity compared to the budgeted amount and the resulting variance. Both Month-to-Date and Year-To-Date comparisons are provided along with the total annual budget amounts for reference.

OPERATING INCOME (FUND ACTIVITY)

- Condominium Revenues – condominium fees are assessed to the owners of the units based on the unit factor based on the current year’s budget.

- Other Income – additional sundry income such as fees collected for keys, fobs, cards, laundry income, social club dues, interest on operating funds, NSF fees etc.

OPERATING EXPENSES

- Contract Expenses – Cleaning, Building, Mechanical, Plumbing, Grounds

- Grounds Maintenance – Landscaping improvements and snow removal in addition to contract

- General Maintenance – Cleaning, Repairs and improvements in addition to contract

- Mechanical – Elevator, heating and other mechanical expenses in addition to fewer deduction expenses (CPP, EI, etc.) and cost of any group benefits if applicable contract

- Amenities & Recreation – Exercise room, pool expenses, etc.

- Wages – Site salaries if the corporation has its own staff exclusive to the condominium which equals the gross salary

- Resources – Utilities including Heating, Electricity, Water and Sewer, etc.

- Administration & Professional – Insurance, Management Fees, Professional Fees (audit, legal), bank charges, photocopying, telephone, office supplies, etc.

FINANCIAL EXPENSES

(RESERVE ALLOCATION)

ADDITIONAL TOOLS – Collection of Working Papers and Reconciliations

A collection of working papers and reconciliations are provided in addition to the Balance Sheet and Income Statements to further explain the numbers presented in those reports.

- Reserve Fund Summary

- Accrued Liabilities

- Due To/From Reserve and Operating Accounts

- Bank Reconciliations

- Aged Payables Summary

- Aged Accounts Receivable

- This list is only a sample of what may be included. Each corporation’s requirements are different, and the final package contains documents outlined in the management agreement.

Typically include copies of various Bank Statements as well. This includes details of all cheques cut for expenses.

DID YOU KNOW

At least two signatures are required on all condo corporation cheques. Usually, one is from the management company and another one or two designated Board Members with signing authority. In some cases, the property management company does not have signing authority and both signatures come from the Board of Directors.

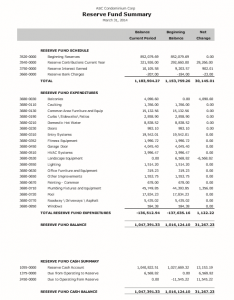

RESERVE FUND SUMMARY

Statement of Income and Expenses for the current reporting period and Year to Date of the Reserve Fund.

More details about Reserve Funds and Reserve Fund Studies are presented later in this guide.

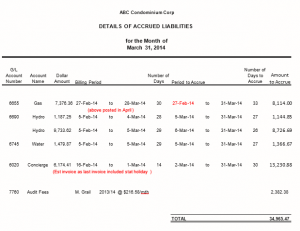

ACCRUED LIABILITIES

Accrued liabilities are expenses that the condo corporation has incurred but has not yet paid. These do not represent payments that are past due as quite often the invoice has not yet arrived.

STATEMENT OF DUE TO/FROM ACCOUNTS

RESERVE AND OPERATING ACCOUNTS

This is essentially an internal Account Receivable showing amounts owed from one account to another within the corporation’s ledger.

BANK RECONCILIATION

The bank reconciliation report compares the bank records to those tracked in the corporation’s account records in order to uncover any possible discrepancies.

AGED PAYABLES SUMMARY

The aged payables summary shows the relationship between a condo corporation’s invoices and its due dates to help see whether it is current on its payments to others. Aging schedules may also be used by creditors in evaluating whether to lend money.

Comparing Aged Payables and Receivables can assist in the prediction of cash flow.

AGED ACCOUNTS RECEIVABLE

Aged accounts receivable is a periodic report that categorizes a condo corporation’s Accounts Receivable according to the length of time an invoice has been outstanding.

Aging schedules may also be used by auditors in evaluating the value of a condo corporation’s receivables.

GENERAL LEDGER

A complete record of financial transactions over the life of a condominium corporation but usually shows only current period transactions with an opening balance equivalent to the ending balance of the previous period

Holds account information that is needed to prepare financial statements, and includes accounts for assets, liabilities, owners’ equity, revenues and expenses

Typically used by condo corporations that employ the double-entry bookkeeping method – where each financial transaction is posted twice, as both a debit and a credit, and where each account has two columns. Because a debit in one account is offset by a credit in a different account, the sum of all debits will be equal to the sum of all credits.

NOTES TO THE FINANCIAL STATEMENTS

It is recommended based on the requirements of the Ontario and Alberta Condo Acts the following information be disclosed in the notes to the financial statements:

ONTARIO

- The date of registration of the corporation and the total number of dwellings or other units;

- A description of the functions of the corporation including the name, not-for-profit status, and date of registration;

- A description of the fund accounting policies adopted by the condo corporation;

- Reserve fund information prescribed by the Act, including a comparison of actual reserve fund allocations and expenses to the planned amounts according to the latest Notice of Future Funding of the Reserve Fund issued to owners;

- Details of any cost-sharing or reciprocal agreements (if not otherwise covered by related party transaction disclosure requirements)

ALBERTA

- Amount of any contributions due and payable in respect of the units

- Statement setting out the amount of the monthly contributions and the basis on which that amount was determined including a statement setting out the unit factors and the criteria used to determine unit factor allocation

- A statement setting out any structural deficiencies that the corporation has knowledge of at the time of the request in any of the buildings that are included in the condominium plan

- Copy of any lease agreement or exclusive use agreement with respect to the possession of a portion of the common property, including a parking stall or storage unit

This list is not intended to be exhaustive. Other disclosures may also be required. The board should carefully review the financial statements to ensure that all required disclosures are made.

3. CONDO CORPORATION BUDGETS

WHY DO YOU NEED A BUDGET?

A condominium corporation’s financial health DEPENDS on its annual budget which:

- Determines for the upcoming 12-month period:

- expected revenues and expenditures

- provisions for reserves and long-term expenditures

- Sets the maintenance fees due from unit owners for the upcoming year.

The budget is prepared with every line item starting from scratch or zero dollars and balanced to zero in the bottom line. This is called a “Zero Based” Budget and is a requirement of Condo law.

WHAT IS INCLUDED IN A TYPICAL BUDGET?

The budget formula is simple. To determine what the year’s condo fees will be you determine the following:

- Standard Operating Expenses

- Reserve Contribution

- Required Surplus

You then subtract any Supplementary Sources of Income and you have the required condo fees for the year.

STANDARD OPERATING EXPENSES:

Standard operating expenses for a condominium corporation depend on the type of community and the amenities within the condo corporation. They relate to the common elements and assets of the corporation – the areas shared by all unit owners.

- Property Management Expense

- Administration Costs

- Cleaners and General Housekeeping

- Concierge / Security / Gatehouse

- Heat, Hydro and Water of common elements

- Maintenance and Repairs

- Energy Management

- Landscaping / Snow Removal / Lawn

- Maintenance

- Exterior Maintenance

- Repairs and Interior Maintenance

THINGS TO CONSIDER:

CONTRACTS:

- Have you seen the contract?

- What is the renewal date?

- Has a price increase been included if not yet known?

ADMINISTRATION:

- Are major projects planned that will require additional communication to owners/residents?

- Have you planned for increase in administration expense

- Are expenses that span over several years spread out across multiple years to prevent periodic spikes?

- Example: insurance appraisal occurs every 3 years so divide the cost by 3 and spread it out evenly

REPAIRS & MAINTENANCE:

- Have you set your wish list? Is each item accounted for?

- Are there any “one time” projects planned that would increase the historical average?

- Were there any “one time” projects completed in the past year included in the historical average that would decrease the budget for the coming year?

UTILITIES:

- Are there any projects underway or planned that would increase or decrease consumption?

- Have you taken into account how far into the fiscal year the increase/decrease would take effect?

- Have any planned rate changes been published in the media?

RESERVE CONTRIBUTION:

The Reserve Fund ensures money will be available for expenses that will arise in the future. A study is performed by an expert who advises how much money should be available and when.

THINGS TO CONSIDER:

More details about Reserve Funds and Reserve Fund Studies are presented later in this guide.

- Are there any major adjustments to the reserve plan in the next 5 years that would require the planned contribution amount to be increased?

- By how much?

- Should a one-time special assessment be considered rather than increasing monthly fees?

- Work with your engineer if time allows

- Are you using the contribution number from the approved reserve fund study?

- You cannot contribute less without issuing an alternate funding plan. This would make the Board of Directors personally liable if they are not correct. They would not be covered by insurance or Corporation documents.

SURPLUS REQUIRED:

A surplus is when general revenues exceed general expenditures at the end of a fiscal year. This does NOT include the Reserve Fund.

Since Condo law requires a Zero Based budget, there must be a plan for what to do with any surplus. Options include:

- Retained as a contingency fund to cover unexpected expenditures in the budget

- Reduce/stabilize maintenance fees

- Top up Reserve Fund – however once in that fund, cannot be retrieved for anything else.

RULE OF THUMB: It is recommended to operate with a surplus or contingency fund equal to the higher of the largest one-time expense (usually insurance) or one month’s condo fees.

Boards should plan for expenses within the regular budget rather than rely on a contingency fund. Large surpluses not only provide temptation to spend impulsively but are wrong.

Condos may not operate in a deficit situation where expenses are greater than revenues. Deficits should be erased within one year after they occur back to a zero base. Special assessments or loans may be necessary to comply. In the rare case that a condo corporation requires a loan, a by-law must be passed so the owner’s opinions can be considered.

THINGS TO CONSIDER:

Does your surplus meet the minimum recommended requirements? It is important that every corporation carry a surplus equal to the higher of 1 month’s condo fees or the largest one-time expense (usually the annual insurance premium).

- If too low, you need to set your revenue plan for a positive balance at the end of the year to increase your overall surplus.

- If too high, consider the following:

- Set up an improvement fund to plan for future projects that will not qualify to come from the reserve fund (accessibility issues required by new government acts, handicap access, levered door handles, new security systems) or new landscape projects, etc.

- Set an income line “Use of Surplus Funds” to lower current year condo fees. Remember that this only delays required increases. Once surplus funds are gone, they are no longer available as a revenue source.

SUPPLEMENTARY SOURCES OF INCOME:

In addition to any surplus remaining from the previous year, any possible sources of income other than condo fees must be budgeted.

THINGS TO CONSIDER:

- Are there any possible sources of income other than condo fees?

- Parking

- Laundry

- Rooftop antennas

- Guest Suite

- Interest

- Are you being conservative?

- Do not overestimate supplementary revenue sources as usage will vary from year to year

- TIP: Budget 65-80% of the current year amount

CONDO FEES:

The maintenance fees collected from the condo owners of the units to cover Expenses, Reserve Contribution, and Surplus required less any Supplementary Sources of Income equal the condo fee to charge for the year in question.

All required expenditures and savings are divided among the units on a percentage basis over the year and then divided into 12 monthly payments based on the size of their unit.

They are akin to rent for services and a joint savings account for future repairs.

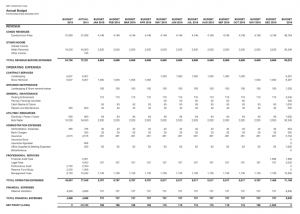

THE ANATOMY OF THE BUDGET

- Break out expenses monthly. Some expenses belong to or have higher/lower amounts in different seasons, some may be one-time, and others may spread evenly across the year

- Compare to past budget and actual expenses

- Balance to zero: Fees amount to what you need to cover expenses

- Separate notes should be included to explain how numbers were arrived at

WHO DOES WHAT?

Budgets are prepared by the Property Manager with input from the Board of Directors. Research and recommendations are made by the Property Manager but the ultimate decision of what is finalized is voted on by entire board for approval.

The Budget is signed off by all Directors with signing authority and then presented to Unit Owners. The budget is the responsibility of the Board of Directors. Owners cannot vote on the budget. Owners instead vote in the Members of the Board of Directors entrusting them to make sound decisions.

BOARD OF DIRECTOR RESPONSIBILITIES:

- Review Revenue and Expense numbers presented by the Property Manager. These may be changed upon review by the Board

- Ensure you are comfortable with the reasons and thoughts behind the numbers

- Confirm the numbers add properly

- Set your wish list and make decisions on what you feel the budget can handle financially

- Ensure there is sufficient income to cover your planned expenses

- Be aware of “need” vs. “want” and be prepared to make difficult decisions. Becoming a board member doesn’t mean you will get everything you want

- If you are uncomfortable with the increase in monthly fees required to accommodate all of your wishes, be prepared to take away projects considered discretionary spending.

WHAT IS A SPECIAL ASSESSMENT?

An additional payment or levy is required when:

- The condo corporation does not have an adequate Reserve Fund to do a repair and cannot charge the expenditure through the operating budget due to lack of funds

- A replacement or large repair resulted in the depletion of the Reserve Fund and needs to be brought up to date.

It cannot be levied if there is a large surplus. It is approved by the Board and Owners cannot vote. Each owner is charged their portion of the assessment in relation to the size of their unit.

Both the assessment and the way of levying it require careful consideration by Condo Boards and adequate communication with owners.

THINGS TO CONSIDER:

- Should it be payable in one lump sum or over a period of time?

- When is it due?

BIG DECISION: Condo Fees – To Increase or Not to Increase

Understandably, condo owners are relieved when fee increases are avoided. Stability in fees is a good thing provided it is NOT to the detriment of the future financial stability of the condo corporation.

Raising Condo Fees

Fee Increases are unavoidable in the following situations:

- Level of service is falling

- Cuts in necessary services would be required

- Repairs not possible

- Reserve Fund is inadequate

Consider Increasing Condo Fees 2-5% each year:

- Follow inflation rate

- Slow, steady increase has less impact than facing a large jump all at once

Not raising fees when required can result in diminished real estate values and unsatisfied owners.

Common Pitfalls of Condo Fee Increases

Tough decisions are required by Boards of Directors. Avoid common pitfalls:

- Fear of defeat by owners refusing fee increases

- Using the promise of low fees to be re-elected

- Approving unnecessary “preventative” maintenance, premature repairs, constant upgrades and inefficient staff

Instead,

- Ensure decisions are made based on well-researched facts

- Ensure fees collected are spend wisely and not squandered

- Ensure you are only paying for costs the corporation is responsible for under your bylaws and charge back expenses due from owners

- Communicate the reasons behind fee increases effectively so they understand the Budget is to protect their investment

- Continue to find creative solutions to problems with efficient use of funds

4. CONDO RESERVE FUND

A reserve fund is a savings account or like an insurance policy which ensures funds are available for special expenditures that may come up in the future. These funds must be kept in a separate account from the operating expense account which is easily accessible and securely invested and not in the stock market or other risky ventures.

WHAT ARE THE RESERVE FUNDS USED FOR?

Condo law indicates Reserve Funds can only be used for replacement and major, nonroutine repairs of common elements and assets of the condo. Regular wear and tear must be covered in the annual budget.

Example: Reserve Funds Being Used for Maintenance

Caulking maintenance, repair and reinforcement of window, although expensive especially in high rises, is a maintenance expense to be covered in the regular budget. Window Replacement is paid for out of the Reserve Fund but not as often if annual maintenance is included in the annual budget.

Upgrades cannot be paid out of the reserve fund. Elements should be replaced with similar quality to the original. However, a case can be made for elements needing replacement be done with better quality if it will solve a problem, protect the corporation or save them money and future problems in the long run.

Example: Reserve Funds Being Used for Upgrades

A broken tile floor cannot be replaced by an expensive marble one. The difference in the cost between the upgrade and the direct replacement must come from the annual budget. Old windows ready for replacement should be replaced with energy-efficient ones even if they are an upgrade from the original style of windows due to the energy conservation and savings.

HOW MUCH SHOULD BE KEPT IN SAVINGS?

The amount to maintain in your Reserve Fund is determined by a Reserve Fund Study. This study determines:

- Inventory of all depreciating property which needs to be repaired or replaced within the next 25 years based on normal use such as heating, plumbing, garages, balconies, windows, etc.

- Present condition of depreciating property and an estimate of when each component will need repair or replacement.

- Estimated costs of repairs or replacement at the required time in the future.

- Life expectancy of each component of depreciating property once it has been repaired or replaced.

- Current amount of funds (if any) included in the corporation’s reserve fund.

- Recommended amount of funds that should be added to the corporation’s reserve fund in order to have enough to cover recommended repairs and replacements and when to have them available.

HOW OFTEN SHOULD RESERVE FUND STUDIES BE DONE?

Comprehensive Reserve Fund Studies must be carried out every three years in Ontario.

In Alberta, the reserve fund study, report and plan must be prepared no later than two years from the day the condominium was registered. This must be done at least every five years moving forward.

WHO SHOULD PREPARE RESERVE THE FUND STUDY?

This study should be performed by experts with a special designation. They may be members of the Appraisal Institute of Canada or other similar accredited groups such as the Ontario Association of Certified Engineers.

TIP: When choosing an expert, ask for a sample Reserve Fund Study they have prepared. Does it educate, offer firm recommendations for safety yet still reasonable and realistic. Remember, the title of Engineer doesn’t make them an expert.

IMPLICATIONS AND CONSEQUENCES OF YOUR DECISIONS AS A BOARD MEMBER

In addition to keeping fees low at the risk of poor everyday upkeep, if the Condo Board fails to maintain an adequate Reserve Fund with increased contributions or special assessments, they could be sued by owners in the future. Directors’ Liability insurance may not cover them if due diligence has not been done.

THINGS TO CONSIDER:

- Replacement and repair costs can rise significantly and, in some cases, more than anticipated in the Reserve Fund Study. Costs must be re-evaluated when the study is regularly updated.

- Changes to laws regarding how work must be performed (special equipment and labour requirements for example) can cause significant increases to estimated replacement and repair costs.

- Changes in weather and use can cause a property to deteriorate at a rate more rapid than predicted.

5. IN SUMMARY

The Reserve Fund Study identifies all the components of a condo property which will depreciate over time and require repair or replacement. It provides timelines, costs, and a plan to ensure money will be available when needed.

The Budget includes the annual contribution toward the savings for future repairs and replacement as determined by the Reserve Fund Study and all expected annual expenses. This determines the number of contributions required from owners cover all of these expenses during the year and ensure they are prepared for future expenses while operating in the best interest of all owners to maintain property values and lifestyle. The budget provides a road map for the condo corporation’s

financial success.

The Financial Statements are provided monthly to ensure the condo corporation is on track, following the road map and executing what was planned.

These pieces of the Condo Corporation’s financial puzzle discussed in this guide assist Members of the Board of Directors to do their job successfully. We hope we have provided you a better understanding of these valuable tools provided to you and the confidence to make the best decisions for your community.